Scale Your Business with Instant Access to Capital

Strategic Funding for the Most Ambitious Business Ventures

DVN Consultation is the ULTIMATE Solution for Securing Working Capital & Business Funding for HIGH-GROWTH Entrepreneurs.

$3.1 million

Instant Capital Acquired

Our 3 Step Funding Process to Cashflow

We’ve simplified business funding into three fast, proven steps—so you can secure up to $250K in 0% interest capital without the delays, denials, or credit risks. From a 90-second pre-approval to full funding in just days, this process is built for serious entrepreneurs ready to scale with confidence.

Step 1:

Fill Out the 5-Minute Quick Application

No stress, no guesswork—just answer a few simple questions so we can instantly pre-qualify you for up to $250K in 0% interest funding through our Pre-Approval

Step 2:

Get Funded In As Little As 90 Seconds

Our proprietary FastTrack Underwriting Process filters out denials and accelerates your approval—so you can access $100K–$250K in 0% interest funding in as little as 90 seconds, not months. It’s instant, it’s smart, and it’s built for entrepreneurs who don’t have time to waste.

Step 3:

Invest & Cashflow

With our 3-Pillar Approval System, you get the highest approval amounts and ongoing support to help you secure repeat funding whenever you need it.

Real People Real Success

"Deandre & DVN Consulting Changed My Life"

From no credit history to securing business funding for my podcast — Deandre made it happen. Grateful for the game-changing support and guidance!

+100% results

"Credit Fixed. Business Funded."

I was stuck—couldn’t get approved for a house or car. DVN Consultations helped fix my credit and even got me business funding. Now I’m thriving! If you need help with credit, they’re the team to call.

+100% results

"From Rock Bottom to Credit Comeback"

I was the poster child for wrecking credit—made every mistake in the book and honestly gave up hope. Then I found Deandre and the DVN Consultations team. In just over two months, they completely turned things around. I’m blown away by the results and so thankful. They truly changed my life!

+100% results

"From 480 to 742 – A Credit Glow."

I took control of my financial health with DVN Consultations, and wow—what a journey! My credit score jumped from 480 to 742 in just a year. I bought a brand new car with no co-signer and now I’m finally in position to buy my first home. The support, tools, and encouragement from DVN were everything. I’m beyond grateful!

+100% results

"DVN Consultations Changed My Life"

DVN Consultations completely changed my life. Deandre helped me boost my credit from the 600s to 700s, get my dream car, and even guided me in starting my own business. I’m so thankful for the support—truly life-changing!

+100% results

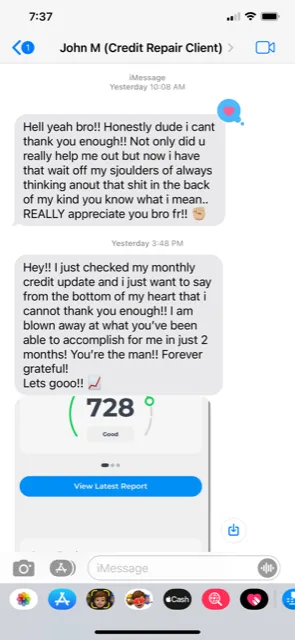

"Client Credit Glow-Up in Just 2 Months!"

Strategic Funding Solutions for Business Growth

We provide expert guidance in choosing the best funding solutions tailored to your business needs. Our strategic approach ensures you secure the right financial support to accelerate growth, scale efficiently, and achieve long-term success.

Zero Percent Business Funding

Get interest-free funding for your small business, startup, or entrepreneurial venture. Perfect for expansion, marketing, or tech investment, all without the stress of paying interest.

Equipment Financing

Stay competitive by covering the cost of essential business tools like machinery or vehicles. Spread payments over time while benefiting from your new equipment right away.

Business Line of Credit

Maintain flexibility with a revolving Business Line of Credit. Use funds for short-term expenses, unexpected opportunities, or working capital. Borrow only what you need and pay interest only on the amount you use.

Term Loan for Team Expansion

Invest in talent! Use a term loan to expand your workforce, boost training, or improve employee benefits. With flexible rates and repayment options, you can focus on your business goals while growing your team.

Why Choose Us?

We help serious business owners access up to $250K in 0% interest funding—fast, without the runaround.

Our team is made up of real funding strategists (not salespeople) who know how to build bank relationships, structure your credit profile, and get you approvals that actually scale your business.

Using our proprietary Funding Success Formula, we’ve helped hundreds of entrepreneurs unlock capital they didn’t even know they qualified for—without hurting their credit or wasting months chasing the wrong lenders.

If you’re ready for a transparent, done-with-you process that actually delivers, you’re in the right place.

Frequently Asked Questions

What is the minimum and maximum amount of funding I can apply for?

We offer funding amounts ranging from $10,000 to $1,000,000 based on your business’s needs and credit standing.

How long does it take to get approved?

Most approvals happen within 48 hours, but timelines may vary depending on your situation.

What are the interest rates and repayment terms?

Rates and terms vary based on the funding option you choose, but we always offer competitive terms.

Do I need to provide collateral for the funding?

It depends on the type of funding. Some options require collateral, while others do not.

What can I use the funding for?

You can use the funds for anything related to business needs—expansion, payroll, equipment, marketing, and more.

No Need to Hire a Loan Broker

Choosing DVN Consultation over a loan broker means no hidden fees or commissions—we only get paid when you do. Unlike brokers who treat you like just another transaction, we offer personalized service tailored to your business needs. Plus, we’re committed to long-term support, helping you secure funding and scale your business successfully.

Facebook

Instagram

Youtube